Richard J. Dennis

In his article titled “Beware of Charles Ponzi”, Piggy looks into how two personalities became the “face of financial evil” and led to the death of trust in investment circles. However, it would be careless to paint every portfolio manager or trader with the same brush as there are indeed some good stories to also recite. One such is the story of the Turtles. It is a story of how a group of non-traders with little or no experience learned to trade for big profits and became trading legends. Commodities speculator; Richard J. Dennis, also known as the “Prince of the Pit” had made his name and fortune trading a range of markets. It is recorded that in the early 1970s, he borrowed USD1,600 and reportedly made USD200 million in about ten years. Richard wagered his friend, William Eckhardt, that anyone could be taught to trade. William Eckhardt, on the other hand, believed that traders were born and not made. To settle the debate, Dennis set up an experiment whereby he would find a group of people to teach his rules and then have them trade real money. The training would last for two weeks and could be repeated over and over. He called his students “turtles” after recalling turtle farms he had visited in Singapore and deciding that he could grow traders as quickly and efficiently as farm-grown turtles.

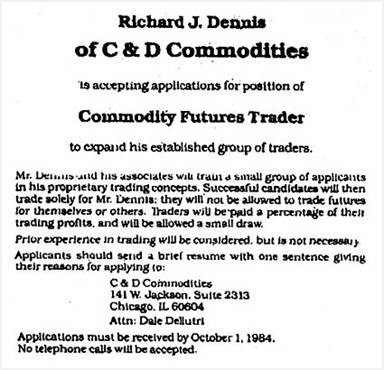

Dennis placed an ad in The Wall Street Journal, and thousands applied to learn trading at the feet of widely acknowledged masters in the world of commodity trading. Only 14 traders made it through the first “Turtle” program. The first program started in 1983.

The Original Turtles advert in the Wall Street Journal

The aim of the program was to provide an entirely mechanical approach that would provide a set of rules that eliminate emotion and judgment. Turtles were taught very specifically how to implement a trend-following strategy. The general idea is that the “trend is your friend” and you should buy breakouts and close the trade when prices start consolidating or reverse. Short trades must be made according to the same principles under this system because a market experiences both uptrends and downtrends. Turtle trading is now a renowned trend-following strategy used by traders in order take advantage of sustained momentum. It looks for breakouts to both the upside and downside and is used in a host of financial markets. Trend followers always wait for a market to move; then they follow it. Capturing the majority of a trend, up or down, for profit is the goal. However, the exact parameters used by Dennis were kept secret for many years and are now protected by various copyrights. According to former turtle Russell Sands, the two classes of turtles Dennis personally trained earned more than USD175 million in only five years. Dennis had proved beyond a doubt that anyone can learn to trade successfully.

The turtle experiment provides us with useful information for both traders and investors. One key lesson is that a system is crucial. Without a clearly defined set of parameters for entries and exits, a trader or investor is merely using his gut instinct. Emotions may lead some to buy or sell stocks without a clear method to enter and exit trades. Generally, most successful traders use a mechanical trading system. A good mechanical trading system automates the entire process of trading or investing and provides answers for each of the decisions a trader must make while trading. In addition, the system makes it easier for a trader to trade consistently because there is a set of rules which specifically define exactly what should be done. This guarantees that the mechanics of trading are not left up to the judgment of the trader.

Piggy makes use of a system in his stock picking approach that it based on two key parameters; (i) the quality of management teams and (ii) future earnings as measured by our Forecasted Earnings Per Share (EPS). The EPS estimates are constantly being updated from time to time to reflect the changing dynamics affecting the company’s earnings potential. Stocks are then ranked based on these two set of parameters to identify winners (BUYs) and losers (SELLs). In conclusion, if you know that your system makes money over the long run, it is easier to take the signals and trade according to the system even during periods of losses. If you are relying on your own judgment, you may find that you are fearful just when you should be bold, and courageous when you should be cautious.

Be part of the fastest growing network of trading and investing enthusiasts by joining a PiggyNetwork WhatsApp Group.

Contact Piggy on +263 78 358 4745